Understanding title loan cash income requirements is crucial for a seamless application process. Lenders verify earnings through various documents, demonstrating financial stability. Self-employed individuals can use tax returns as alternative proof. Flexible payment plans are available, and lenders accept unique documentation like utility bills or vehicle inspection reports to ensure responsible lending and broaden access to cash for diverse borrowers.

In today’s financial landscape, understanding title loan cash income acceptance is crucial for accessing immediate funding. This article delves into the intricacies of meeting income requirements for title loans, offering a comprehensive guide for borrowers. We explore alternative documentation options and strategies to navigate challenges in income verification. By understanding these aspects, folks can ensure they have the necessary tools to secure necessary capital, even if traditional methods prove problematic.

- Understanding Title Loan Cash Income Requirements

- Alternative Documentation for Title Loans

- Navigating Challenges in Income Verification

Understanding Title Loan Cash Income Requirements

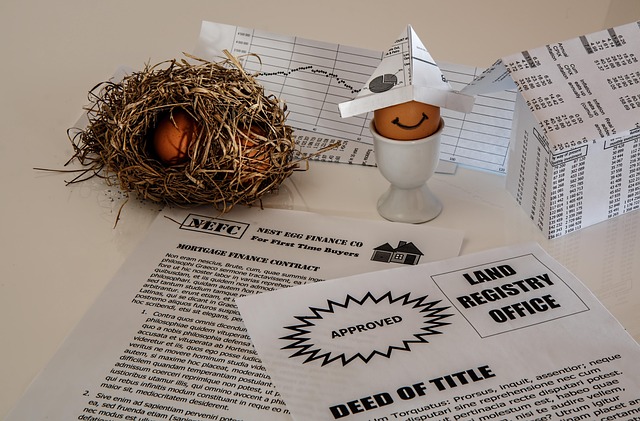

When applying for a title loan cash income, understanding the requirements is crucial for a smooth process. Lenders will assess your ability to repay by verifying your income source. This typically involves examining employment records, pay stubs, or bank statements to confirm direct deposit and stable earnings. The need for proper documentation is essential for both title loan cash income acceptance and ensuring the borrower’s financial stability.

In addition to traditional employment verification, alternative documentation options are available. For instance, self-employed individuals or freelancers can provide tax returns or business revenue records as proof of income. Motorcycle title loans, similar to other types, often require borrowers to demonstrate their ability to make consistent payments. Flexible payment plans are offered by many lenders to accommodate various financial situations, making it easier for borrowers to access the funds they need while managing repayment obligations effectively.

Alternative Documentation for Title Loans

When it comes to alternative documentation for Title Loans, borrowers have options beyond traditional financial statements. In many cases, lenders accept proof of income through unique methods, especially when dealing with secured loans like title loans, which use a borrower’s vehicle as collateral. This flexible approach can be a lifeline for those in need of emergency funding and who may not have conventional documentation readily available.

Instead of relying solely on pay stubs or tax returns, lenders often consider alternative sources such as utility bills, bank statements, or even employment verification letters. These documents provide a glimpse into an individual’s financial health and ability to repay the loan, ensuring responsible lending practices. By accepting these alternatives, borrowers can navigate challenges related to loan payoff and access much-needed cash when traditional routes may be blocked.

Navigating Challenges in Income Verification

Many borrowers seeking title loan cash income acceptance face challenges when it comes to verifying their earnings. Traditional methods often rely on direct deposit statements or payroll records, but not all applicants have access to such documentation. This is especially true for those in the gig economy or self-employed individuals who may not have a consistent employer or formal payroll system. As a result, lenders need to adopt alternative verification methods to ensure accurate assessment of an applicant’s financial health.

One solution is to utilize vehicle inspection reports as a means of indirect income verification. By assessing the condition and value of a borrower’s vehicle, lenders can gain insights into their financial stability. For instance, a well-maintained boat title loan could indicate responsible asset management and a stable source of income, even if traditional documentation is not readily available. This approach allows for a more inclusive lending process, catering to a broader range of borrowers while maintaining the integrity of income assessment during title loan cash acceptance.

In navigating the process of securing a title loan, understanding and providing acceptable documentation, including alternative forms of verification, is key. By exploring options beyond traditional income statements, borrowers can overcome challenges related to income verification and gain access to much-needed funds. This flexible approach to title loan cash income acceptance allows for greater inclusivity, ensuring that those with unconventional employment or limited paperwork still have a viable path to financial support.