Understanding income requirements is crucial for qualifying for a Title Loan Cash Income. Lenders verify employment and income sources, with steady employment or business income improving approval chances. The evaluation process considers vehicle collateral value, condition, borrower financial history, and income verification. Meeting minimum criteria like valid ID, proof of residency, clear title, and providing necessary documentation is essential for successful application and securing title loan cash income acceptance.

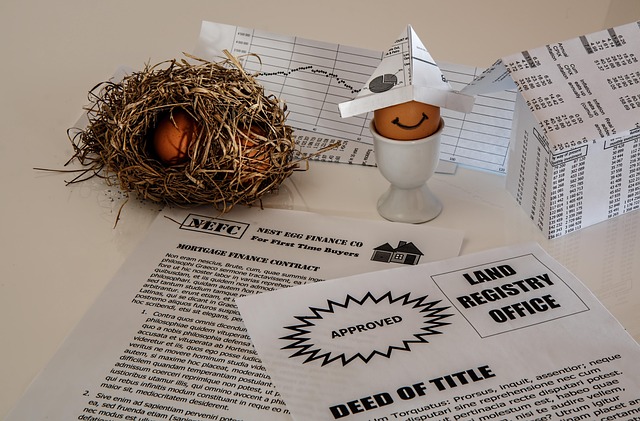

In today’s financial landscape, understanding title loan cash income acceptance policies is crucial for those seeking quick liquidity. This article demystifies the process, providing a clear guide on how lenders evaluate and accept applications. We delve into the key requirements, from understanding income verification to navigating common eligibility criteria. By the end, folks will be equipped with insights to increase their chances of securing title loan cash income approval.

- Understanding Title Loan Cash Income Requirements

- The Evaluation Process for Acceptance

- Common Eligibility Criteria and How to Meet Them

Understanding Title Loan Cash Income Requirements

When applying for a Title Loan Cash Income, understanding the income requirements is crucial to ensure your eligibility. Lenders typically assess your ability to repay the loan by verifying your income sources. This can include employment records, pay stubs, or government benefits. The key is to demonstrate a steady and reliable stream of income, which acts as collateral for the loan.

The assessment goes beyond just your job. Factors like the type of employment (full-time, part-time, self-employment), stability, and the overall amount earned can influence your approval chances. For instance, consistent income from a stable job or business is often favored over temporary or sporadic earnings. Motorcycle Title Loans, while offering quick cash, may have stricter credit checks and income verification processes compared to traditional loans, as the vehicle’s valuation plays a significant role in determining loan amounts.

The Evaluation Process for Acceptance

The evaluation process for accepting a title loan application involves a thorough review of various factors to ensure the borrower’s ability to repay. Lenders assess the value of the vehicle serving as collateral, examining its condition and market worth. This step is crucial in determining the loan amount offered, as it directly impacts the available cash income for the borrower. Additionally, lenders carefully consider the borrower’s financial history, including their credit score and existing debt obligations.

While direct deposit of funds is a common method, some lenders might require additional documentation to verify the borrower’s income. This includes pay stubs, tax returns, or bank statements. Meeting the minimum loan requirements, such as a valid government-issued ID, proof of residency, and a clear title, is essential for a successful application. Lenders aim to strike a balance between providing accessible short-term funding and maintaining responsible lending practices.

Common Eligibility Criteria and How to Meet Them

In the world of title loan cash income acceptance, understanding the eligibility criteria is key to securing financial assistance when you need it most. Lenders typically consider a few core factors to assess an applicant’s ability to repay. These common eligibility criteria include having a clear vehicle title in your name, demonstrating stable employment or a consistent source of income, and providing valid identification.

Meeting these requirements is straightforward. For instance, ensuring your vehicle is free of any liens or outstanding loans allows for a clear title transfer. Maintaining steady employment or proving self-employment income through tax documents can help lenders verify your financial stability. Additionally, having valid government-issued ID ensures a smooth application process and acts as a crucial verification step, especially when considering a no credit check policy for direct deposit of funds.

When it comes to securing a title loan, understanding the cash income acceptance policies is key. By comprehending the requirements, evaluation process, and common eligibility criteria, you can navigate the application with confidence. Remember, meeting these guidelines increases your chances of getting approved for the funds you need quickly. So, whether you’re looking to cover unexpected expenses or make a significant purchase, a clear understanding of title loan cash income acceptance policies is the first step towards financial stability.