Title Loan Cash Income Acceptance: Individuals with poor credit or limited history can access quick funds using their vehicle's title as collateral in bustling urban areas like Dallas and San Antonio. Lenders assess vehicle value for loan amounts, require valid ID, proof of ownership, and income verification, and may conduct inspections. This method offers swift approval, convenient online applications, and emergency financial support, though interest rates and penalties are factors to consider.

“Uncovering the financial flexibility offered by title loan cash income acceptance, this comprehensive guide navigates an often-overlooked avenue for borrowers. Understanding how this unique lending option works is crucial, especially for those with non-traditional income sources. We’ll explore in detail the eligibility criteria and benefits of using cash income from a title loan, empowering you to make informed decisions regarding your financial needs.”

- Understanding Title Loan Cash Income Acceptance

- Eligibility Criteria for Title Loans with Cash Income

- Benefits and Considerations of Using Cash Income from a Title Loan

Understanding Title Loan Cash Income Acceptance

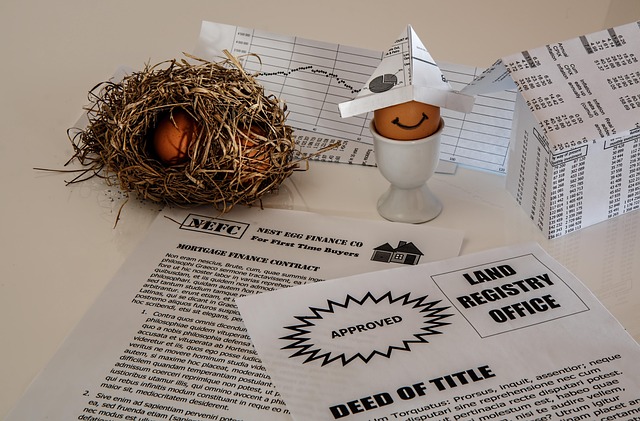

Title Loan Cash Income Acceptance refers to the process where individuals can secure loans by using their vehicle’s title as collateral. This alternative financing method is particularly appealing to those who may not qualify for traditional bank loans due to poor credit or lack of substantial financial history. It offers a quick and convenient way to access cash, especially in emergencies or unexpected financial situations. The concept is simple: you hand over your vehicle’s title to the lender, who then holds it as security until the loan is repaid.

For many, this option provides a safety net, particularly in cities like Dallas Title Loans or San Antonio Loans areas where quick access to cash is often needed. However, it’s crucial to understand the terms and conditions before agreeing to such an arrangement. Lenders will typically assess the value of your vehicle and offer a loan amount based on that assessment, along with setting forth clear repayment expectations. Responsible borrowing ensures you retain control over your vehicle while gaining much-needed financial assistance.

Eligibility Criteria for Title Loans with Cash Income

When considering a Title Loan with Cash Income Acceptance, understanding the eligibility criteria is crucial. Lenders typically require borrowers to meet specific standards to ensure responsible lending practices. The primary factors include having a valid driver’s license or state ID, proof of vehicle ownership, and verification of income. Income acceptance plays a significant role in determining the loan amount you can secure, as lenders assess your ability to repay based on your financial status.

Vehicle valuation is an essential aspect, where the lender will appraise your car to establish its worth, which directly impacts the loan-to-value ratio. Interest rates vary among lenders, and understanding these rates is key to finding a suitable option. During the application process, a vehicle inspection may be conducted to confirm the condition of your car, ensuring it meets the minimum requirements set by the lender. These criteria ensure that both the borrower and the lender are protected, fostering a transparent and fair lending environment.

Benefits and Considerations of Using Cash Income from a Title Loan

Using cash income from a title loan can offer several benefits for individuals seeking quick financial support. One of the key advantages is its accessibility; it provides an alternative financing option for those who may not qualify for traditional loans due to poor credit or a lack of collateral. With a title loan, borrowers can leverage their vehicle’s equity, allowing them to gain immediate access to cash without the lengthy application processes often associated with bank loans. This can be particularly useful in emergency situations or when unexpected expenses arise.

Additionally, the approval process for title loan cash income acceptance is generally faster and more efficient than other loan types. Borrowers can complete an online application, providing their vehicle’s details and necessary personal information. Once approved, the lender facilitates a quick title transfer, ensuring funds are accessible promptly. While there are considerations, such as interest rates and potential penalties for early repayment, the convenience and speed of this option make it an appealing choice for many in need of immediate financial relief.

Title loans offering cash income acceptance can be a viable option for individuals seeking quick financial support. By utilizing their vehicle’s equity, borrowers can access funds without strict credit requirements. However, it’s crucial to understand the terms and conditions, as these loans often come with high-interest rates and short repayment periods. Carefully weighing the benefits and considerations will help ensure that a title loan with cash income acceptance is the right choice for meeting immediate financial needs.