Title loan cash income acceptance offers quick funding using car titles as collateral, avoiding lengthy bank loan processes. With simple requirements and flexible payments, it provides immediate financial support for emergencies or unexpected expenses. Lenders assess applications based on vehicle condition and credit history, with approved borrowers receiving funds within hours. Proper financial management involves understanding interest rates, repayment periods, and potential consequences.

In today’s fast-paced financial landscape, immediate access to funds is more crucial than ever. Car title loan cash income acceptance has emerged as a game-changer for many individuals seeking instant financing. This innovative approach allows borrowers to leverage their vehicle ownership, providing quick cash in exchange for the title. Understanding this process and its benefits can empower folks to navigate through financial challenges effectively. Explore the advantages, navigate the steps involved, and discover how this option offers a viable solution for unexpected expenses.

- Understanding Title Loan Cash Income Acceptance

- Benefits of This Instant Financing Option

- Navigating the Process and Common Scenarios

Understanding Title Loan Cash Income Acceptance

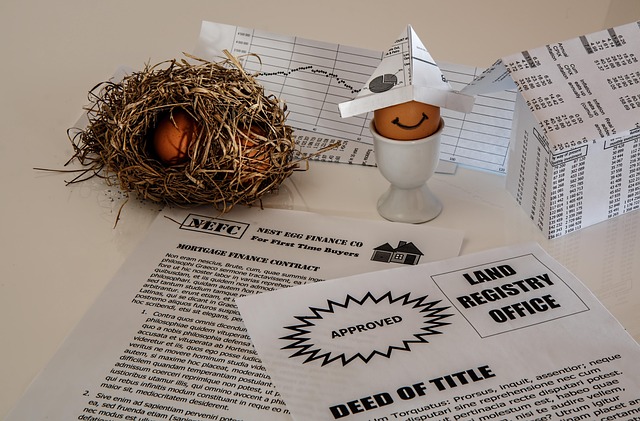

Title loan cash income acceptance refers to the process where individuals can tap into the equity of their vehicles to secure a short-term loan. This type of financial assistance is particularly appealing for those seeking quick funding, as it offers a straightforward and often faster alternative to traditional bank loans. The key aspect lies in using the car title as collateral, allowing lenders to provide funds based on the vehicle’s value.

This method streamlines the application process, making it convenient with many online platforms offering digital applications. Once approved, borrowers can receive their cash funding within a short timeframe, providing a reliable source of financial assistance for emergencies or unexpected expenses. It’s an efficient solution, especially for folks who need money in a hurry, without the extensive waiting period often associated with conventional loans.

Benefits of This Instant Financing Option

In today’s fast-paced world, immediate financial support is often a necessity rather than a luxury. This is where the benefits of a Title Loan cash income acceptance shine. This financing option offers an unparalleled level of convenience and accessibility for individuals seeking quick funding. By leveraging the value of their vehicle, borrowers can secure a loan with relatively simple requirements, enabling them to gain access to much-needed capital within hours.

One of the key advantages is the flexibility it provides in terms of repayment. Unlike traditional loans, the Title Loan process allows borrowers to make flexible payments tailored to their financial comfort levels. This feature ensures that the burden of repaying a loan doesn’t weigh heavily on one’s budget, making it a practical solution for short-term cash flow challenges. Additionally, the entire procedure is streamlined, ensuring that individuals can navigate the process quickly and efficiently without lengthy paperwork or extensive waiting periods associated with conventional banking options.

Navigating the Process and Common Scenarios

Navigating the process of obtaining a car title loan cash income acceptance can seem daunting at first. However, with some basic understanding, borrowers can ensure a smoother experience. The first step involves providing clear vehicle ownership documentation and proof of income. This demonstrates your ability to repay the loan. Lenders will then assess your application, taking into account factors like credit history and the condition of your vehicle. If approved, you’ll receive funds, keeping your vehicle as collateral until the loan is repaid.

Common scenarios include borrowers seeking short-term relief for unexpected expenses or those needing quick cash for emergency repairs. Fort Worth loans, for instance, have become a popular choice due to their accessibility and relatively lenient requirements compared to traditional bank loans. Keep Your Vehicle remains a key advantage, as it allows individuals to maintain possession of their asset while accessing much-needed capital. Understanding loan terms and conditions is crucial; this includes interest rates, repayment periods, and potential consequences of late payments or default. Proper financial management ensures a positive experience with car title loans.

Title loan cash income acceptance has revolutionized instant financing, offering a reliable option for individuals seeking quick financial support. By understanding the benefits and navigating the process efficiently, borrowers can leverage this alternative lending method to access much-needed funds. With its wide availability and favorable terms, title loan cash income acceptance provides a practical solution for those in need, ensuring better financial flexibility and peace of mind.