Title loan cash income acceptance provides a swift financial solution using your vehicle's title as collateral, bypassing traditional loan applications. Individuals with less-than-perfect credit or urgent needs can access funds based on their vehicle's value through transparent vehicle valuation. The process involves gathering documents, disclosing payoff preferences, discussing loan requirements, and careful contract review to ensure fairness and transparency.

In today’s fast-paced world, immediate financial solutions are increasingly sought after. One such option gaining traction is car title loan cash income acceptance—a game-changer for borrowers in need of quick funds. This article explores this innovative approach to lending, delving into its mechanics and the advantages it offers. We’ll guide you through understanding how this process works, considering the benefits and potential drawbacks, and navigating the steps to secure the much-needed cash from your vehicle’s title.

- Understanding Car Title Loan Cash Income Acceptance

- Benefits and Considerations for Borrowers

- Navigating the Process: What to Expect

Understanding Car Title Loan Cash Income Acceptance

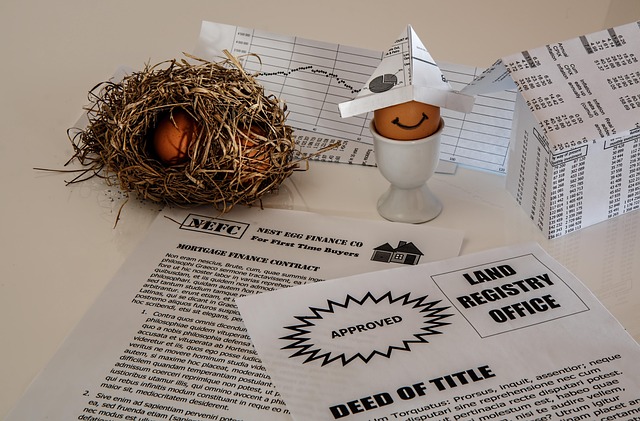

Car Title Loan Cash Income Acceptance is a financial solution that has gained significant popularity due to its immediate and accessible nature. This process allows individuals to use their vehicle’s title as collateral for a loan, providing them with much-needed cash in a short amount of time. It is particularly attractive to those seeking quick funds without the lengthy application processes associated with traditional loans.

Understanding how this system works involves a simple concept: you hand over your vehicle’s title to a lender, who then holds it as security for the loan. This ensures that if you fail to repay the loan according to the agreed-upon terms, the lender has the legal right to take possession of your vehicle. However, upon successful repayment, including any associated fees, the title transfer is reversed, and the borrower regains ownership of their vehicle. This option is especially appealing for those with less-than-perfect credit or who need a loan payoff in a hurry, even considering alternatives like Motorcycle Title Loans.

Benefits and Considerations for Borrowers

For borrowers looking for quick cash, a car title loan can offer a viable solution, with one key advantage being title loan cash income acceptance. This means that even if you have poor credit or no credit history, your vehicle’s value can serve as collateral. It provides an opportunity to access funds quickly, which is particularly useful in emergencies or unexpected financial situations. By leveraging the equity in your vehicle, borrowers can obtain a loan and maintain their vehicle’s ownership, making it a flexible option compared to traditional loans.

Additionally, vehicle valuation plays a significant role in this process. Lenders assess the market value of your car to determine the maximum loan amount you may qualify for. This ensures transparency and allows borrowers to understand the potential outcome. Furthermore, with flexible payments, many title loan services offer tailored repayment plans, making it easier to manage debt without the added stress of rigid repayment structures often associated with other types of loans.

Navigating the Process: What to Expect

When considering a car title loan as a source for cash income acceptance, understanding the process is key. The first step involves gathering essential documents, such as your vehicle’s registration and proof of insurance. This ensures that the lender has the necessary information to verify ownership and evaluate the condition of your vehicle. Once these are submitted, you’ll need to disclose your loan payoff preferences, whether it’s a lump-sum payment or a structured repayment plan.

The next phase involves discussing the specific loan requirements with the lender. They will assess factors like your creditworthiness, income stability, and the overall value of your vehicle to determine the loan amount offered. After agreement on terms, the cash advance is disbursed, providing you with the financial support you need. The process is designed to be efficient, but it’s crucial to read all contracts thoroughly and ask questions to ensure a fair and transparent transaction.

Car title loan cash income acceptance has become a widely available option, offering borrowers a quick and convenient way to access funds. By understanding the process, benefits, and considerations outlined in this article, you can make an informed decision about whether a car title loan is right for your financial needs. Remember that while this option provides immediate cash, responsible borrowing practices are essential to avoid potential drawbacks.